Term Or Permanent Life Insurance

Insurance is an important tool of protecting ourselves, our family and our assets. It is an integral part of any investment planning. There are various insurance agencies and various types of insurance you can go in for. So how do you decide which insurance is good for you. Different types of life insurance are:

Term insurance: Term life insurance lasts as long as the tenure of the policy. This is a pure insurance which means there are no cash benefits associated with this policy. The policy can be taken for 1-30 years. If the insured survives the number of years of the policy no cash benefit will be provided once the policy expires. In case the insured dies during policy term, his / her beneficiary will receive the sum assured.

Permanent Life Insurance consists of Whole life, Variable life and Universal life insurance.

Whole Life Insurance: This type of insurance has no time limit associated with it. This policy continues till the death of the insured. You have to regularly pay annual premiums for it. In addition to providing life coverage, this policy also keeps on building cash value. After a certain period you can even take loan against accumulated cash which are 'tax-free'. But this type of insurance is a little inflexible as the insured person does not have the choice of selecting his investment portfolio.

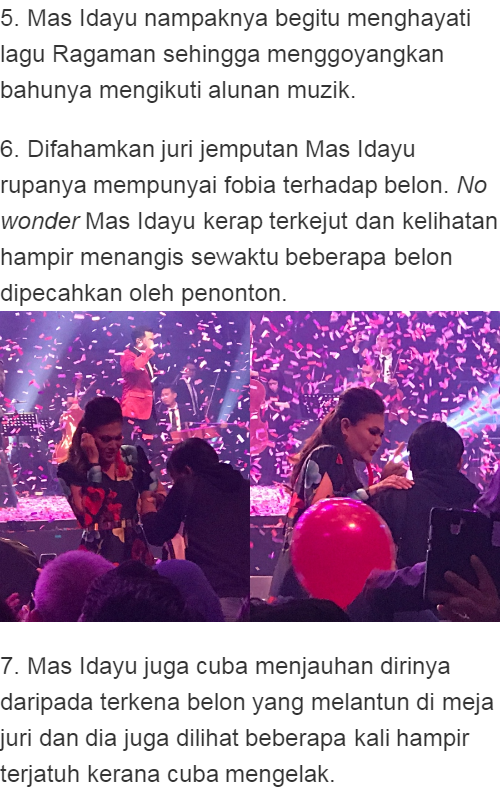

Variable Insurance: This type of insurance provides a certain level of flexibly to the insured. The insured has the power to decide where to invest his money from a host of options provided by the insurance company's portfolio. This is the most expensive of all cash-value insurance policies.

Universal Insurance: This insurance India policy builds up cash value in addition to providing life cover. The insured has the flexibility to vary the premium and savings of the policy from time to time according to his wishes. You can also make your annual premium payments from the accumulated cash value over the years.

The cheapest insurance you can get is group insurance. This typically is provided by the company you work for and is a term insurance policy. Your access to the life cover provided by group policy lasts as long as you continue to work for the company.

There are various factors which decide the overall cost of the insurance policy. Like which type of policy you are buying, the amount you are buying it for, your overall health, occupation etc. Whole life insurance policies are generally costlier than term life insurance. Since whole insurance also gives you an investment option, the premium that you pay for it is considerably higher than term insurance premium. You must study the insurance documents minutely before going ahead with purchasing a policy, as insurance companies usually deduct agent commission and a variety of fees from your premium paid. The agents generally avoid disclosing all costs and expenses related to a policy and only after you have bought the policy do you get to know about them. Insist upon studying a policy brochure and understanding the policy in detail before committing your hard earned money for the policy.